News

Tax Reforms: CESJET, 50 other CSOs lead support for Tinubu’s Bills At Senate Public Hearing

As the tax reform bills continue to generate interest across the country, the Centre for Economic and Social Justice (CESJET) and 50 other civil society organizations (CSOs) have intensified its support to ensure that the Bills gain wider acceptance in the country.

have thrown their weight behind President Bola Tinubu’s tax reform bills.

This endorsement came during a Senate public hearing, where stakeholders gathered to discuss the proposed legislation.

The tax reform bills, introduced by President Tinubu in October 2024, aim to overhaul Nigeria’s tax system. The proposed laws comprise four primary bills: the Nigeria Tax Bill 2024, Tax Administration Bill, Nigeria Revenue Service Establishment Bill, and Joint Revenue Board Establishment Bill.

The CESJET and other supporting CSOs, in separate memos submitted to the Senate Committee on Finance, agreed that the tax reform bills will simplify the tax system, enhance compliance, and create a more business-friendly environment.

They also argue that the proposed laws will boost revenue generation for sustainable development, addressing Nigeria’s relatively low tax-to-GDP ratio.

According to the CSOs, the phased increase in Value-Added Tax (VAT) from 7.5% to 15% by 2030 will provide a stable source of revenue for the government, enabling it to fund critical infrastructure projects and social programs.”

The groups also commended the bills for introducing exemptions from corporate income tax for small businesses with annual turnovers below ₦N50 million, adding that this provision will stimulate entrepreneurship, innovation, and economic development, particularly in rural areas.

Bilal Abdulahi, CESJET Spokesman added: ” The tax reform bills will improve tax administration, reduce corruption, and increase transparency while the establishment of the Nigeria Revenue Service and the Joint Revenue Board will enhance revenue collection, reduce tax evasion, and promote accountability.

“We welcome the introduction of a 5% excise duty on telecommunications services, which they believe will generate significant revenue for the government.

“We believe that the tax reform bills will have a transformative impact on Nigeria’s economy, promoting growth, development, and prosperity for all citizens.”

Meanwhile, the Coalition of Civil Society Organisation on Economic Watch described the bill as a critical piece of legislation that has the potential to transform Nigeria’s tax system and promote economic growth, fairness, and transparency.

“The Coalition urges this very distinguished committee of the Senate of the Federal Republic of Nigeria to pass this Bill as a Legacy Bill for the 10th Assembly and the presidency to drive the Nigeria state towards the much anticipated multi-trillion Dollar economy in the years to come,” Opialu Fabian Opialu, its convener said.

On its part, the Save Humanity Advocacy Centre (SHAC) said the bills will also enhance Nigeria’s tax credibility and reputation among international investors, making the country a more attractive destination for foreign investment.

According to its Executive Director, Dr. Ben Amodu, the bills will promote fiscal federalism, allowing states and local governments to retain a larger share of revenue generated from taxes, thereby enabling them to fund development projects and improve public services.

However, the group called

The group, however, urged the Federal Government to establish a robust Tax Education and Awareness Program to educate citizens on tax matters, particularly the reforms, in their local languages and dialects.

In its submission, the Empowerment from Unemployed Youth Initiative (EUYI) said it would be the biggest beneficiary of the contents of this bill when it hopefully becomes an act and takes effect.

Comrade Momoh Danesi, its national president, added: “The bills have the potential to create jobs and stimulate economic growth if implemented effectively. The Bills’ provisions, such as reduced tax rates, simplified tax compliance, and increased investment incentives, demonstrate a clear commitment to promoting a business-friendly environment.

“However, to fully realize the Bill’s job-creation potential, it is essential to address the challenges and limitations highlighted in this discussion. This includes providing targeted tax incentives for job-creating sectors, reducing tax rates for SMEs, and investing in infrastructure and vocational training.

“Furthermore, regular review and update of the tax laws and regulations are crucial to ensuring they remain relevant and effective in creating jobs and stimulating economic growth.”

News

Federal fire service decorates 130 officers in Kano

The Kano State Command of the Federal Fire Service (FFS) has decorated 130 officers recently promoted to various ranks in a ceremony held in Kano.

The Command’s Controller in the state, Kazeem Sholadoye disclosed this in a statement issued by the service’s Public Relations Officer, Al-Hassan Kantin on Wednesday in Kano.

Congratulating the officers, the state controller described their promotion as well deserved and a call to greater responsibility and professionalism.

Sholadoye charged the officers to see their new ranks as an opportunity to demonstrate increased commitment to protection of lives and property.

He reminded them that promotion comes with higher expectations in service delivery.

Speaking on behalf of the promoted officers, Deputy Superintendent of Fire in the command, DSF Abdullahi Muhammad expressed appreciation to the management for organising what he described as a befitting ceremony.

He reiterated the readiness of the officers to rededicate themselves to duty and uphold core values of the Federal Fire Service.

News

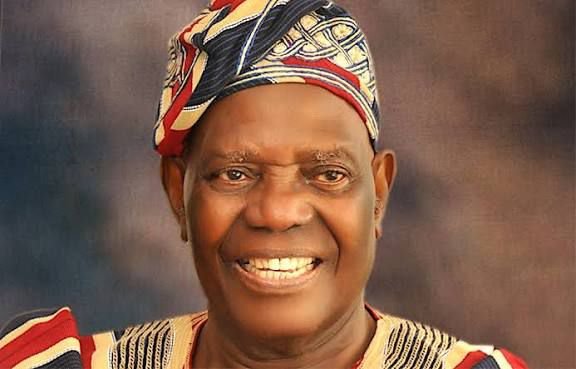

Tinubu salutes Bisi Akande’s national legacy at 87

President Bola Tinubu has paid glowing tributes to Chief Bisi Akande, elder statesman and former APC national chairman, as he marked his 87th birthday.

Tinubu said this in a special tribute on Thursday to celebrate Akande’s life of service and democratic commitment.

He described Akande as a towering figure who contributed significantly to Nigeria’s political development and democratic institutionalisation.

The President said Akande’s political journey was shaped by Chief Obafemi Awolowo’s progressive ideology and commitment to public service.

Akande began his career as an accountant with British Petroleum before leaving the private sector for public service.

He served as Secretary to the State Government in old Oyo State in 1979 and later became Deputy Governor during the Second Republic.

Tinubu noted that Akande later served as Governor of Osun from 1999 to 2003, where he further distinguished himself.

As interim chairman of the APC, Akande laid the foundation for the party’s historic victory in 2015, Tinubu said.

The President praised Akande’s leadership, integrity, industry and sacrifices for the party and the nation.

He described Akande as a mentor whose guidance, advice and encouragement shaped his political journey.

Tinubu said Akande’s continued support for his administration and the Renewed Hope Agenda remains invaluable.

He noted that, even at 87, Akande remained a firm advocate of democracy, social justice and good governance.

The President prayed for Akande’s good health and renewed strength as he marked the milestone birthday.

News

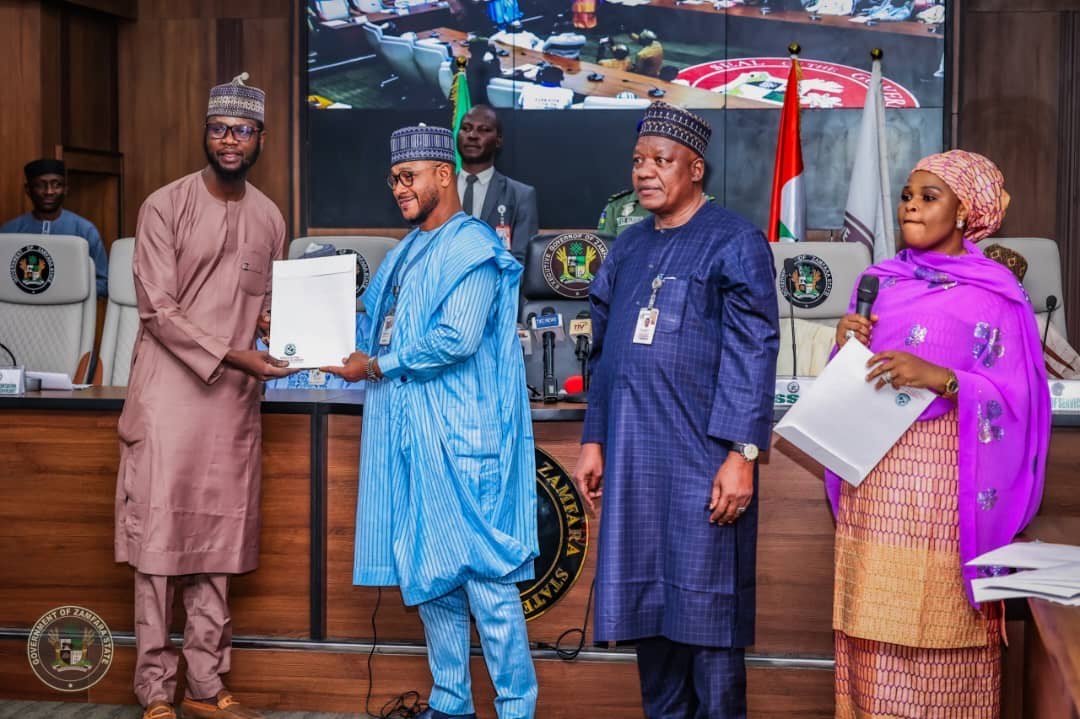

Lawal presents certificates to 50 Crescent varsity graduates 9 years after graduation

Gov Dauda Lawal, on Thursday presented certificates to 50 former students of the Crescent University, Abeokuta, Ogun, nine years after their graduation.

This is contained in a statement by the governor’s spokesperson, Sulaiman Idris in Gusau, Zamfara.

The presentation took place at the Grand Chamber of the Government House, Gusau.

According to Idris, the former students, who were on the state government’s scholarship, graduated nine years ago, but could not receive their certificates due to the state government’s failure to settle their outstanding tuition fees owed the institution.

“The former students were left hanging for nine years because their tuition fees were not settled.

“The Crescent University declined to release the students’ results due to the non payment of their outstanding tuition fees.

“The state government, under Gov. Dauda Lawal, after carefully studying the case, reached out to the university and settled the outstanding tuition fees.

“Among the 50 students, is a First Class graduate in Chemistry and several Second Class Upper degree holders,” he said.

While presenting the certificates to the graduates, Lawal restated his commitment to revamping the educational sector.

Lawal also reaffirmed his administration’s commitment to continue to prioritise education to enhance the even development of the state.

-

Cover5 months ago

Cover5 months agoNRC to reposition train services nationwide.. Kayode Opeifa

-

Fashion9 years ago

Fashion9 years agoThese ’90s fashion trends are making a comeback in 2017

-

Entertainment9 years ago

Entertainment9 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Opinion1 year ago

Opinion1 year agoBureaucratic Soldier, Kana Ibrahim heads Ministry of Aviation and Aerospace After Transformative Tenure at Defence

-

Opinion1 year ago

Opinion1 year agoHon. Daniel Amos Shatters Records, Surpasses Predecessor’s Achievements in Just Two Years

-

Opinion2 months ago

Opinion2 months agoBarrister Somayina Chigbue, Esq: A rising legal leader shaping institutioal excellence in Nigeria

-

News6 months ago

News6 months agoNigerian Nafisa defeats 69 Countries at UK Global Final English Competition

-

Special Report1 year ago

Special Report1 year agoGolden Jubilee: Celebrating Tein Jack-Rich’s Life of Purpose and Impact