Opinion

Keyamo’s Skyward Drive: Bold Reforms Propel Aviation

By Damilare Ogunleye

For much of the last decade, Nigeria’s aviation industry was stuck in a familiar loop of chronic under-investment, regulatory inconsistencies, and a reputation that deterred serious international lessors. However, when President Bola Ahmed Tinubu appointed Festus Keyamo as Minister of Aviation and Aerospace Development in August 2023, a new era began. Twenty months later, the sector has witnessed a significant transformation. Nigeria is no longer known primarily for high insurance premiums and grounded aircraft but for a deliberate, rules-based push to become West Africa’s most competitive aviation hub, instilling a sense of optimism for the future.

Keyamo’s first—and arguably most market-moving—intervention was the formal adoption of administrative rules for the Irrevocable De-registration and Export Request Authorisation (IDERA). This move, which removed ambiguity surrounding repossession rights, triggered an immediate five-point increase in the Cape Town Convention (CTC) Compliance Index. Within twenty-four hours, Nigeria’s compliance index jumped from 70.5% to 75.5%, propelling the country into the CTC’s ‘high-compliance’ tier and removing Nigeria from the Aviation Working Group’s watch list. The implications are significant: CTC compliance directly affects lease rates, insurance premiums, and lessors’willingness to place modern aircraft in Nigerian fleets. In other words, a few percentage points difference translates into cheaper—and more abundant—capacity for domestic carriers.

Building on this momentum, in early 2025, Keyamo flagged off revised aviation insurance regulations that allow operators to cede up to 90 per cent of their hull risk to international markets. Aligned with CTC standards, this framework is expected to compress insurance costs and, by extension, reduce ticket prices that have historically outpaced the purchasing power of many Nigerian travellers. These adjustments not only improve financial metrics but also play an indirect role in safety: lower insurance costs free up capital that carriers can reinvest in maintenance, crew training, and modern equipment. The broader strategy is clear: restore investor confidence, tighten regulatory oversight, and make flying more affordable and safer for the average Nigerian.

Yet the minister did not stop at compliance. His playbook relies heavily on local content multipliers designed to keep more aviation-related revenue within Nigeria’s economy. Two initiatives stand out. The Fly Nigeria Act, currently before the National Assembly, would mandate that all government-funded travel—estimated at ₦420 billion annually—be booked on Nigerian flag carriers whenever viable point-to-point or code-share options exist. If passed, the Act promises a guaranteed revenue pipeline and higher fleet utilisation for domestic airlines that have struggled to fill seats at sustainable yields. Complementing this, the local catering mandate, effective January 1, 2025, requires every international carrier operating in Nigeria to source in-flight meals from Nigerian-certified caterers. Early compliance reports indicate a significant increase in order volumes, prompting new kitchen investments in Lagos and Abuja and creating over a thousand direct jobs within weeks of implementation. Together, these policies signal a deliberate shift from import-dependent aviation services toward local value-chain development—an approach that mirrors Tinubu-era reforms in oil and digital services, instilling a sense of optimism about the growth of Nigeria’s aviation sector.

At the same time, Keyamo placed a pronounced emphasis on elevating safety culture across airlines and agencies. Recognising that regulatory improvements are insufficient without robust operational practices, his ministry partnered with Boeing’s Global Learning Institute (BGLI) and Cranfield University to pilot a five-day “Advanced Leadership in Safety Excellence” program for executives and senior leaders from all domestic carriers. Drawn from the Seattle MOU, participants underwent immersive training in safety risk assessment, decision-making under pressure, and the implementation of Safety Management Systems (SMS). Early feedback indicates that at least three carriers have since established or updated their internal SMS frameworks, resulting in a 12-percent reduction in minor safety incidents during the first quarter of 2025 compared to the same period in 2024. By instilling a top-down commitment to safety, Keyamo has helped shift airline boardrooms toward framing operational risk as both a moral imperative and a business enabler.

Meanwhile, at Murtala Muhammed International Airport (MMIA) in Lagos, newly installed e-gates have reduced arrival processing times from an average of forty-five minutes to under fifteen minutes—reducing crowding and minimising fatigue-related errors among immigration officers. Coupled with the Ministry of Interior’s automated 48-hour e-visa platform and mandatory online landing-card system, immigration’s “open-skies, closed-loopholes” mantra has finally gained operational traction. Faster, more accurate passenger screening reduces the likelihood of human error, a frequent contributor to security breaches. Upcountry, the upgrade of Maiduguri’s Muhammadu Buhari Airport to full international status—scheduled to begin operations on January 1, 2025—anchors a strategic East-West belt linking the Chad Basin’s commerce corridors to Gulf carriers. Simultaneously, the foundation-laying for Abia State’s new airport at Ubaha Nsulu signals a willingness to diversify air-connectivity nodes beyond the traditional Lagos–Abuja–Port Harcourt triangle. These capital projects, some of which will be built or operated under public-private partnerships, are designed to stimulate local economic development, reducetravel times, and foster intra-regional trade while incorporating international best practices for runway safety and fire-rescue readiness.

Credibility on paper means little unless airlines can convert it into “metal”—that is, modern aircraft maintained to stringent safety standards. To that end, Keyamo has spent as much time courting stakeholders abroad as he has on tarmac inspections at home. Most visibly, he led a Nigerian delegation to the Boeing Lessor Forum during the Airline Economics Growth Frontiers Conference in Dublin, where he made a data-driven case for longer-term leases and lower security deposits. He emphasised the newly attained 75.5 per cent CTC rating and the cadre of senior managers returning from Boeing-Cranfield safety training, arguing that Nigeria’s improved safety culture and regulatory environment significantly reduce counterparty risk. In parallel, a memorandum signed in Seattle with Boeing’s BGLI has already produced tangible results: at least two airlines report upgraded flight-data monitoring (FDM) systems and stricter crew-rest compliance. Together, these efforts aim to equip younger, more fuel-efficient fleets with better standard operating procedures, an imperative as jet fuel remains tied to global oil prices, which are hovering near $90 per barrel.

Diplomacy has yielded tangible route and partnership gains as well. Following protracted negotiations, Keyamo’s team replaced Alitalia with Italy’s Neos SPA Airlines on the Milan–Lagos route, ensuring continuity of European connectivity despite Alitalia’s dissolution. In the Gulf, the minister successfully amended the Bilateral Air Services Agreement (BASA) with the United Arab Emirates, re-opening code-share channels and revising slot allocations that had been frozen during a 2022–23 dispute. The revised BASA also includes provisions for technical training, maintenance, repair, and overhaul (MRO) collaboration, as well as joint airworthiness surveillance, sending promising cadets to Emirates centres in Dubai for hands-on experience. Simultaneously, discussions with Algerian authorities culminated in an agreement to establish a tri-nation corridor linking Algeria, Nigeria, and Cameroon—both a political signal of regional integration and a practical new revenue stream for airlines hungry for short-haul traffic.

Behind the scenes, Keyamo has targeted grey-market leakage in private charter operations—a ministerial task force led by Capt. Ado Sanusi of Aero Contractors estimated that unauthorised charters were siphoning off ₦120 billion in annual revenue from government departments and high-net-worth travellers. Their recommendations—spanning mandatory manifest filing, transponder-based flight-tracking mandates, and stiffer fines for unlicensed operators—are now before the Nigerian Civil Aviation Authority (NCAA). If implemented and enforced, these measures could redirect substantial sums into legitimate operators and government coffers, simultaneously reducing the safety risks associated with poorly maintained, unregulated airframes.

Within the broader machinery of government, the Nigerian Airspace Management Agency (NAMA) earned ISO 9001 certification in December 2024 and received a SERVICOM Award of Excellence for customer service reforms. These institutional badges matter because they reassure foreign players—lessors, insurers, and airlines—that Nigeria’s air navigation services meet the stringent quality-management benchmarks they demand in Europe or the Gulf. Equally important, a stable, standards-driven NAMA reduces the risk of flight delays and cancellations tied to air traffic bottlenecks, directly affecting airlines’ on-time performance metrics and minimising the exposure of passengers and crew to avoidable risks.

Early economic dividends are already visible. Oxford Economics estimates that aviation’s share of Nigeria’s GDP could increase from 0.4 per cent to nearly 1 per cent by 2030 if Keyamo’s reforms continue to drive traffic growth. Job creation has accelerated: catering facilities have added over 1,200 roles since the implementation of the local-content directive, while ICT contractors report brisk demand for e-visa platform maintenance and real-time data analytics. Cargo volumes through MMIA have increased by 18 per cent year-over-year, primarily due to smoother customs integration and more predictable flight schedules. Tourist arrivals through international routes increased by 12 per cent in the first quarter of 2025 compared to the same period in 2024, indicating the ripple effects of lower ticket costs, improved safety culture, and enhanced brand perception.

Risks remain. Macroeconomic headwinds—especially foreign-exchange volatility—could erode lease-rate gains just attained. Structural challenges, from erratic power supply at secondary airports to security concerns in parts of the North-East, continue to inflate insurers’ war-risk surcharges. The Fly Nigeria Act must also withstand intra-party wrangling in the National Assembly; airlines reliant on government contracts may resist provisions that shift travel budgets to smaller, less established carriers. Finally, global aviation remains vulnerable to geopolitical shocks—any sudden oil price spike or North Atlantic crisis could quickly reverse hard-won traction.

Yet, judged against the baseline of August 2023, the trajectory is unmistakable. By combining compliance housekeeping, rigorous safety training, investor outreach, and uncomplicated pro-local policies, Festus Keyamo has transformed Nigeria’s aviation ministry from an afterthought into a potential linchpin of President Tinubu’s economic agenda. The next three years will determine whether these reforms reach cruising altitude, but for now, at least, the runway has never looked clearer.

Damilare , a communications strategist , lives in lagos and can be reached on penhallconsults@gmail.com

Opinion

No More Pipeline Vandalism in The Niger Delta, But…

APPRAISING MILITARY RESOLVE AND THE PATH TO SUSTAINABLE OIL SECURITY

By Aaron Mike Odeh

On a recent media assessment visit by the Director, Defence Media Operations, Major General Michael E Onoja on the 20 January 2026, the General Officer Commanding (GOC), 6 Division of the Nigerian Army and Commander Land Component Operation DELTA SAFE, Major General Emmanuel Emeka, stated that there will be “no more pipeline vandalism in the Niger Delta” indicating a strong affirmation of military resolve and institutional confidence in the ongoing operations within Nigeria’s most economically strategic region.

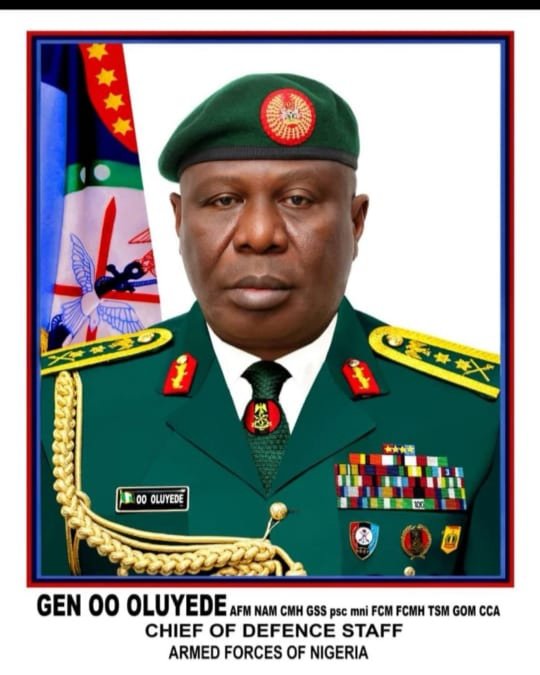

Far from being a casual statement, the pronouncement reflects the operational posture, command clarity, and renewed determination of the Nigerian Armed Forces (AFN) under the leadership of General Olufemi Oluyede. It signals a clear message: the era of unchecked sabotage of national economic assets is being decisively confronted.

CONTEXTUALISING THE GOC’S DECLARATION

Statements of this magnitude from a serving GOC carry both symbolic and operational weight. They are rooted in firsthand command experience, intelligence assessments, and measurable gains on the ground. In this regard, Major General Emmanuel Emeka’s assertion should be understood as a projection of confidence derived from sustained military engagement, improved coordination with sister security agencies, and enhanced operational discipline within the 6 Division’s area of responsibility.

The Niger Delta has long posed complex security challenges due to its difficult terrain, extensive pipeline networks, and the activities of organised criminal syndicates. Against this backdrop, the GOC’s declaration underscores a belief that the Nigerian Armed Forces has reached a level of operational advantage sufficient to deter, disrupt, and dismantle pipeline vandalism networks.

OPERATIONAL GAINS AND MILITARY PROFESSIONALISM

Under Major General Emmanuel Emeka’s command, the 6 Division has intensified patrols, improved intelligence-led operations, and sustained pressure on illegal refining camps and crude oil theft routes. These efforts align with the Federal Government’s strategic objective of securing oil infrastructure as a matter of national economic security.

The GOC’s statement therefore reflects not mere optimism, but a professional assessment of the division’s growing capacity to dominate the operational environment. It also reinforces the Nigerian Armed Forces constitutional role as a stabilising force, committed to safeguarding national assets in support of economic recovery and investor confidence.

THE “BUT”: BEYOND KINETIC SUCCESS

While commending the resolve and achievements of the 6 Division, it is equally important to situate the declaration within a broader national framework. The “but” in the statement should not be interpreted as doubt or contradiction; rather, it represents an acknowledgment of the multifaceted nature of pipeline security in the Niger Delta.

Pipeline vandalism has historically been sustained not only by criminal intent, but also by socioeconomic pressures, environmental degradation, and the absence of alternative livelihoods in some host communities. Military success, while indispensable, achieves greater durability when complemented by effective civil governance, economic inclusion, and community trust-building.

COMMUNITY ENGAGEMENT AS A FORCE MULTIPLIER

One of the strengths of recent military operations in the Niger Delta has been improved civil-military relations. The success of the Armed Forces is closely tied to cooperation from local communities, traditional institutions, and credible stakeholders.

Sustainable pipeline security is most effective when host communities become partners in protection rather than passive observers. The GOC’s declaration implicitly places responsibility on all stakeholders—government agencies, oil companies, community leaders, and youths—to consolidate the gains made by the Armed Forces.

INSTITUTIONAL SYNERGY AND NATIONAL RESPONSIBILITY

The efforts of the 6 Division do not exist in isolation. They form part of a wider national security ecosystem involving regulatory agencies, intelligence services, law enforcement bodies, and policy institutions. The GOC’s confidence should therefore inspire complementary actions across these sectors.

Oil companies must uphold environmental standards and transparent community engagement. Regulatory bodies must enforce accountability. Development agencies must deliver visible dividends of peace. These non-military actions reinforce the security umbrella provided by the Nigerian Armed Forces.

LEADERSHIP AND STRATEGIC MESSAGING

Major General Emmanuel Emeka’s statement also serves as strategic communication—boosting troop morale, reassuring investors, and reinforcing public confidence in the Armed Forces of Nigeria. Such leadership messaging is essential in shaping national narratives around security, discipline, and state authority.

By articulating a firm stance against pipeline vandalism, the GOC is not only commanding troops, but shaping expectations and setting benchmarks for operational success.

CONCLUSION

The declaration that there will be “no more pipeline vandalism in the Niger Delta” should be seen as a reflection of strengthened military capacity, improved leadership focus, and renewed institutional confidence under Major General Emmanuel Emeka, GOC 6 Division of the Armed Forces.

The Nigerian Armed Forces has demonstrated readiness to secure critical national assets. The task ahead is to consolidate these gains through sustained operations, inter-agency synergy, and socio-economic interventions that address underlying vulnerabilities.

In this context, the GOC’s statement stands as both an assurance and a call to collective national responsibility—one that deserves commendation, support, and strategic follow-through.

Aaron Mike Odeh, a Public Affairs Analyst Media Consultant and Community Development Advocator wrote from Post Army Housing Estate Kurudu Abuja

Opinion

Appraising NUPRC’s New Tempo

By Grace Ameh

As a woman who has spent years admiring the quiet strength of sisters carving paths in Nigeria’s demanding energy sector, my heart swelled with genuine joy the moment Chief Mrs. Oritsemeyiwa Eyesan’s appointment as Commission Chief Executive of the Nigerian Upstream Petroleum Regulatory Commission was announced.

Here stands a remarkable daughter of the Niger Delta, graceful yet fiercely determined, becoming the first woman to lead our nation’s upstream regulator. Her rise feels deeply personal, like watching a beloved sister finally claim the spotlight she has long deserved.

The NUPRC, as a young agency born from the transformative Petroleum Industry Act of 2021, has shouldered enormous responsibilities in a complex and evolving landscape—navigating fluctuating production levels amid global energy shifts, addressing delays in data dissemination that can affect investor planning, tackling the persistent menace of crude oil theft that impacts national revenue, and working to enhance transparency in licensing rounds and asset management for greater stakeholder confidence.

This institution emerged with bold ambitions to modernise regulation, attract investment, and optimise Nigeria’s hydrocarbon resources, yet it has operated in an environment marked by inherited challenges and the need for continuous adaptation to deliver on its mandate.

Then, in December 2025, President Bola Tinubu nominated Chief Mrs Eyesan as the first woman to lead NUPRC, a move swiftly confirmed by the Senate.

My spirit lifted immediately. Chief Eyesan’s journey inspires every woman dreaming big in this field. She holds a Bachelor of Education in Economics from the prestigious University of Benin, graduating in 1986 with a solid foundation in economic theory, market analysis, and project evaluation—skills that would prove invaluable in the complex world of energy finance and strategy.

Her academic grounding equipped her to navigate large-scale investments and regulatory frameworks with precision. Early in her career, she honed her financial acumen in banking, serving as Branch Manager at People’s Bank of Nigeria and later as Treasury Officer at Gulf Bank, before joining NNPC in 1992.

Over nearly 33 years, she rose steadily through roles in planning, procurement, corporate strategy, and sustainability, culminating as Executive Vice President, Upstream, until her retirement in November 2024. In that position, she oversaw strategic management of Nigeria’s upstream operations, led sustainability initiatives, strengthened financial discipline, and guided critical reforms aligned with the PIA.

Since assuming office, Chief Eyesan has brought a refreshing wave of purpose and collaboration to NUPRC. Her patriotic commitment shines brightly as she aligns the Commission’s work with President Tinubu’s Renewed Hope Agenda, emphasising increased crude oil production to enhance energy security and revenue, accelerated gas monetisation to advance the Decade of Gas vision, and robust transparency measures to rebuild investor trust.

I admire her focus on digitisation; she is thoughtfully integrating digital tools to improve operational efficiency, accountability, and ease of business, cutting through layers of bureaucracy that once slowed progress. Her leadership style feels deeply relatable—inclusive and engaging. With an open-door policy and regular town halls, she encourages staff input while forging stronger ties with stakeholders, labour unions, and professional bodies.

She champions environmentally sustainable practices, ensuring growth does not come at the cost of our land and waters. Her strategic vision unfolds organically: boosting crude reserves and output for economic stability, scaling gas utilisation for power generation and exports, fortifying regulations to attract long-term investments, nurturing technical expertise through partnerships and capacity building, and embedding digitisation hand-in-hand with transparency to foster dynamic, confidence-inspiring growth.

In these early weeks of January 2026, tangible steps are emerging. She has advanced the 2025 licensing round, scheduling a key pre-bid conference for January 14 in Lagos to draw fresh capital into exploration and development. Partnerships, such as deepened synergy with the Nigerian Midstream and Downstream Petroleum Regulatory Authority, highlight her collaborative spirit.

What touches me profoundly is how Chief Eyesan views challenges as opportunities. She inherited an agency needing revitalisation but approaches it with grace, strategy, and unyielding diligence—that workaholic patriotism we so admire in trailblazing women. Her experience positions her uniquely to resolve legacy issues, unlock stranded assets, and position NUPRC as Africa’s premier regulator.

Reflecting on this new era, sisterly pride overwhelms me. Chief Mrs. Oritsemeyiwa Eyesan is truly an Amazon—resilient, visionary, and devoted to Nigeria’s progress. In her capable hands, the upstream sector is not just recovering; it is poised to soar, delivering sustainable wealth for generations.

Dear sister, you embody the hope we renew daily. The light of your leadership illuminates our path forward, proving once again that when a woman of substance rises, the nation rises with her.

*Ameh an Oil and gas expert writes from Kaduna.

Opinion

FIFA World Cup: Counting the costs of Super Eagles missed opportunities

By Victor Okoye

As the football world prepares for the expanded 48-team 2026 FIFA World Cup, Nigeria is facing the prospect of missing the global showpiece for the eighth time since its inception in 1930, a development that has drawn concern from football stakeholders and sports administrators in the country.

The Super Eagles, who made their World Cup debut at USA 1994, have qualified for the finals six times but failed to reach the tournament on seven previous occasions.

Should Nigeria fail to qualify for the 2026 edition, it would mark the eight miss and a second consecutive absence, further highlighting the rising cost of non-participation in an era of unprecedented financial rewards.

Historically, missing the World Cup was largely a sporting setback. Financial incentives were modest in earlier tournaments.

In USA 1994, FIFA’s total prize money stood at about 62 million dollars, with champions Brazil earning roughly four million dollars.

France 1998 offered about 131 million dollars in total prize money, while winners received around six million dollars.

The figures rose steadily to 300 million dollars at Brazil 2014 and 440 million dollars at Russia 2018 and Qatar 2022.

However, FIFA’s recent review has significantly raised the stakes.

The FIFA Council has approved a record 727 million dollars financial package for the 2026 World Cup, to be co-hosted by the United States, Canada and Mexico.

At an estimated exchange rate of 1,500 naira to the dollar, the total sum translates to about 1.09 trillion naira.

Of this amount, 655 million dollars (approximately 982.5 billion naira) will be shared as prize money among the 48 participating teams.

Champions will earn 50 million dollars, runners-up 33 million dollars, third place 29 million dollars and fourth place 27 million dollars.

Teams finishing between fifth and eighth will receive 19 million dollars, ninth to 16th are to receive 15 million dollars, 17th to 32nd will pocket 11 million dollars, while teams ranked 33rd to 48th will earn nine million dollars.

Each qualified nation will also receive 1.5 million dollars as preparation funds.

This guarantees every participating team a minimum of 10.5 million dollars — about 15.75 billion naira — before the tournament begins.

Nigeria’s 2026 qualification campaign ended in disappointment after the Super Eagles finished second behind South Africa in their group and lost the African playoff final to the Democratic Republic of Congo (DR Congo) on penalties.

To date, no public official report has broken down the total operational costs or expenditure to prosecute the 2026 World Cup qualifying campaign (travel, allowances, camps, logistics) but there are concerns and scrutiny over Nigeria Football Federation (NFF) finances.

The scrutiny includes how funds received from FIFA and CAF have been used over the years following the House of Representatives move to probe more than 25 million dollars in FIFA/CAF grants given to the NFF between 2015 and 2025, citing accountability questions.

However, the NFF has petitioned FIFA over alleged player-eligibility breaches by DR Congo, a move that has reopened debate within the football community.

Reacting to the situation, former Super Eagles captain and 1994 AFCON winner, Mutiu Adepoju, described the possibility of another World Cup absence as “a huge setback”.

“Missing one World Cup is painful, but missing two in a row is unacceptable for a country like Nigeria. Beyond pride, the financial loss is enormous and affects football development at all levels,” Adepoju said.

Former NFF Technical Director, Austin Eguavoen, said qualification had become more critical than ever due to the new prize structure.

“In the past, the World Cup was more about exposure. Now, the money involved can change the entire football ecosystem. Missing out means missing an opportunity to invest in grassroots and infrastructure,” Eguavoen said.

Chairman of the Nigeria Premier Football League (NPFL), Gbenga Elegbeleye, said the impact would also be felt in the domestic league.

“When the national team is at the World Cup, it attracts attention to our league and players. Absence reduces visibility, sponsorship interest and confidence in the system,” Elegbeleye said.

Similarly, former Minister of Sports, Solomon Dalung, said Nigeria must treat World Cup qualification as a national project.

“The Super Eagles missing the World Cup repeatedly shows deeper administrative and structural issues. The financial consequences alone should force stakeholders to rethink planning and accountability,” Dalung said.

On the legal challenge before FIFA, NFF Secretary-General, Dr Mohammed Sanusi, confirmed that the matter was under review.

“We have submitted our petition and we are waiting for FIFA’s decision. The rules are clear on nationality and eligibility, and we believe the issues raised deserve careful consideration,” Sanusi said.

If FIFA rules in Nigeria’s favour, the Super Eagles could be reinstated into the intercontinental playoffs, restoring a pathway to qualification and access to guaranteed earnings of at least 15.75 billion naira.

Failure would confirm Nigeria’s eighth World Cup absence, with consequences ranging from lost revenue and reduced global visibility to diminished influence in international football.

With the 2026 World Cup set to deliver the highest financial rewards in FIFA history, stakeholders agree that Nigeria can no longer afford repeated absences from football’s biggest stage.

-

Cover5 months ago

Cover5 months agoNRC to reposition train services nationwide.. Kayode Opeifa

-

Fashion9 years ago

Fashion9 years agoThese ’90s fashion trends are making a comeback in 2017

-

Entertainment9 years ago

Entertainment9 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Opinion1 year ago

Opinion1 year agoBureaucratic Soldier, Kana Ibrahim heads Ministry of Aviation and Aerospace After Transformative Tenure at Defence

-

Opinion1 year ago

Opinion1 year agoHon. Daniel Amos Shatters Records, Surpasses Predecessor’s Achievements in Just Two Years

-

Opinion2 months ago

Opinion2 months agoBarrister Somayina Chigbue, Esq: A rising legal leader shaping institutioal excellence in Nigeria

-

News6 months ago

News6 months agoNigerian Nafisa defeats 69 Countries at UK Global Final English Competition

-

Special Report1 year ago

Special Report1 year agoGolden Jubilee: Celebrating Tein Jack-Rich’s Life of Purpose and Impact